Understanding the nuances of insurance quotes isn't just beneficial, it’s crucial for making informed decisions. The fine print in insurance documents often holds the key to understanding exactly what you're getting and what you’re not. By taking a closer look at the details, you can ensure peace of mind and financial security.

In this article, we will highlight three critical areas within the fine print of insurance quotes that you should keep in mind: Coverage Limits, Deductibles and Co-Pays, and Exclusions and Special Conditions. Each of these elements plays a significant role in determining firsthand what your policy will, and will not, cover.

By grasping these concepts, you will be better equipped to navigate the often overwhelming world of insurance and safeguard against unexpected expenses.

1. Coverage Limits

Coverage limits refer to the maximum amount an insurance company will pay for a covered loss. This can significantly influence your financial liability in the event of a claim. Therefore, understanding the extent of those limits is essential before signing up for a policy.

When exploring coverage limits, it’s vital to ask specific questions about what exactly is covered under your policy and the scenarios that may lead to payouts. This diligence can prevent unpleasant surprises down the line when you might need to rely on your coverage most.

- Understand the maximum payout for each coverage type (e.g., property damage, liability).

- Review annual limits versus per-incident limits; they might differ.

- Consider how coverage limits might affect your premiums. Pay higher premiums for higher limits or lower premiums for lower limits.

Being aware of your coverage limits is not only a smart financial move but also contributes to peace of mind. Before your policy takes effect, ensure you have the coverages necessary to protect your interests adequately.

2. Deductibles and Co-Pays

Deductibles and co-pays are critical components of insurance policies that determine how much you pay out-of-pocket before the insurance company pays for a claim. Understanding these costs is vital because they can significantly impact your overall financial responsibility.

For many insurance policies, the deductible is the amount you must spend for covered services before your insurer begins to pay. Co-pays are typically fixed amounts required for specific services, like doctor visits or emergency room visits, and can be due at the time of service.

- Know how much your deductible is and how it applies to your policy.

- Different services may have different co-pays; familiarize yourself with these amounts.

- Evaluate whether higher deductibles could reduce your premium costs.

It's crucial to differentiate between the deductible and co-pay as they affect your payments differently. High deductibles typically lead to lower monthly premiums but can result in higher out-of-pocket costs if a claim arises. Understanding these aspects will help ensure you can manage your expenses effectively.

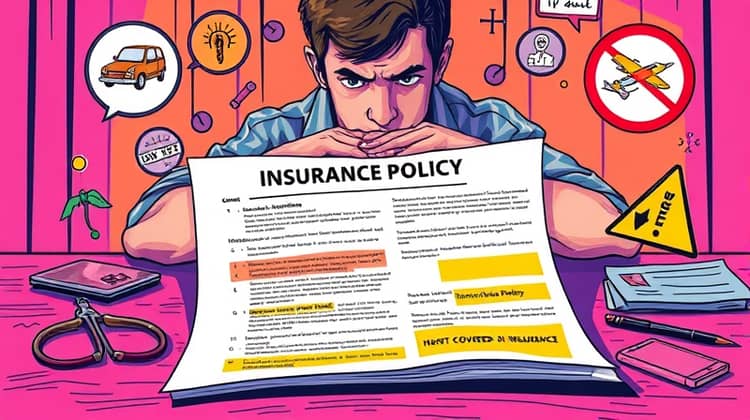

3. Exclusions and Special Conditions

Exclusions are specific circumstances or scenarios that are not covered by the insurance policy. Being aware of these exclusions is essential because they can leave sizeable financial gaps when you are relying on your insurance during a crisis.

Certain insurance policies may also have special conditions that dictate how coverage is applied. These can include stipulations that may limit coverage under specific circumstances, especially for high-risk activities or pre-existing conditions.

- Read the fine print regarding any exclusions that could impact you.

- Pay attention to special conditions that may require additional steps for claims to be honored.

- Consult your insurance agent about any unclear items regarding exclusions or special conditions.

Taking the time to understand exclusions and special conditions is critical for any insurance policyholder. Being caught off guard by exclusions can cause significant financial hardship, especially during emergencies. Thus, ask proactive questions to clarify any vague terms before agreeing to a policy.

Taking these precautions can safeguard your financial future and ensure that you're protected under the most critical circumstances, ultimately leading to greater satisfaction with your policy’s performance.

Conclusion

Navigating the fine print of insurance quotes may seem daunting at first, but comprehending key points can provide a significant advantage when selecting a policy that aligns with your needs.

By carefully examining coverage limits, deductibles and co-pays, and exclusions and special conditions, you ensure that you will have a clear understanding of your policy's ramifications. This foresight can potentially lead you to avoid costly misunderstandings down the line.

Investing time in understanding these aspects of your insurance will result in more informed decisions, ultimately leading to a stronger sense of security. It empowers you to choose an insurance policy that will act as a dependable safety net when life presents unforeseen challenges.