In an increasingly cashless society, the debate over whether to use a credit card or cash for your purchases is more relevant than ever. Each option has its set of advantages and disadvantages, and understanding them is crucial to making informed financial decisions.

This article will explore five key considerations—convenience, rewards, security, spending habits, and debt management—that can help you determine the best payment method for your needs.

Convenience

In a fast-paced world, convenience often dictates the choices we make, especially when it comes to payments. Credit cards offer a level of convenience that cash simply cannot match, allowing quick transactions without the need to carry bills or coins.

Moreover, using a credit card can be significantly easier for online purchases. More and more consumers prefer the speed and efficiency of entering a card number rather than dealing with cash, which can be cumbersome when shopping digitally. But convenience also comes with considerations that should not be overlooked.

- Ease of carrying and using without the need for physical money.

- Fast transactions, both in-store and online.

- Potential for automatic payments and scheduled billing.

- Purchasing items without needing to physically locate cash or coins.

Despite these benefits, relying too heavily on the ease of credit card transactions can sometimes lead to unintentional habits that are less financially sound. It's important to balance the convenience of credit cards with mindful spending practices to avoid financial pitfalls.

Rewards and Cash Back

One of the most appealing reasons people are drawn to credit cards is the rewards and cash back programs that many companies offer. By using your credit card for daily transactions, you can earn points, miles, or a percentage back on your spending.

These incentives can lead to significant savings over time, especially for regular expenses like groceries, gas, or utilities. However, the key to maximizing these benefits lies in understanding how best to utilize cards without incurring debt.

- Cash back rewards are often available on everyday purchases.

- Points can be redeemed for travel, merchandise, or gift cards.

- Some cards offer sign-up bonuses that can increase rewards opportunities.

- Every card has different reward structures; choose wisely based on your spending patterns.

Yet, it’s vital to approach these rewards programs with caution. If the lure of earning rewards leads to overspending, the benefits could easily be outweighed by the interest accrued on unpaid balances. The goal should always be to spend responsibly and reap the rewards without the associated risks.

Security

In the realm of financial transactions, security is a paramount concern. Credit cards generally offer better protection against fraud and unauthorized transactions compared to cash. Should your card be lost or stolen, most credit card companies provide means to dispute charges and limit liability.

In contrast, cash does not offer the same layer of security. Once cash is gone, it's gone—there's no way to recover lost or stolen bills or coins, making cash transactions riskier in certain settings.

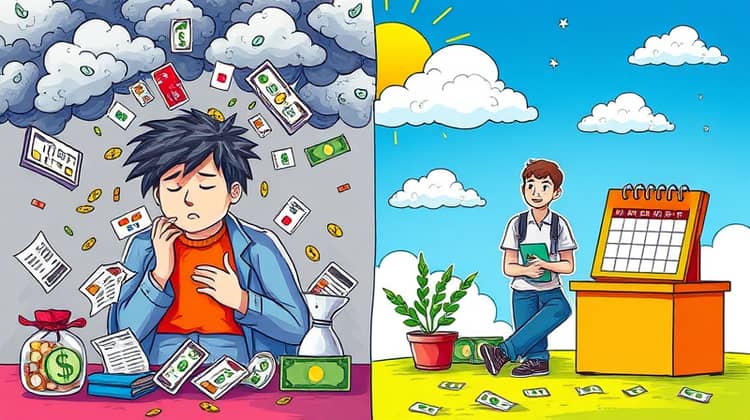

Overspending

While credit cards can be convenient, they can also make it easy to overspend. The ability to charge purchases without immediately recognizing the hit to your budgeting can lead to a cycle of debt if not managed correctly.

- Psychological tendency to spend more with a card than cash.

- The lack of physical connection to money can desensitize spending habits.

- Consequences of minimum payments leading to long-term debt.

- Credit limits may encourage expenditures that exceed realistic budgets.

Being mindful of spending habits and maintaining a budget while using a credit card is essential. Using cash can often create a more tangible financial experience, making you more aware of your spending.

Debt and Interest

Debt management is one of the crucial aspects of financial literacy. Credit cards often come with high-interest rates, and carrying a balance from month to month can quickly lead to significant financial strain. While spending on a credit card can yield rewards, it can also lead to a cycle of debt that is difficult to escape if you're not careful.

Cash, on the other hand, requires you to live within your means, as you cannot spend what you do not have. This discipline can be beneficial in avoiding debt altogether. However, the challenge remains in managing your financial resources effectively, regardless of the payment method used.

- High-interest rates can accumulate quickly if balances are not paid off timely.

- Carrying debt influences credit scores negatively, affecting homes, loans, etc.

- Sticking to a budget is practically necessary when using credit cards.

- Debt can rapidly increase with overspending and unexpected expenses.

Understanding the implications of accruing credit card debt versus using cash empowers consumers to make informed decisions. Striking the right balance between convenience and responsible use is key to maintaining financial health.

Ultimately, it is generally wise to pay off the balance of any credit card monthly to avoid interest charges and potential debt issues. Credit cards can be a powerful financial tool when used responsibly.

Conclusion

In conclusion, both credit cards and cash have their respective advantages and disadvantages that should be considered carefully. While credit cards offer convenience, rewards, and better security, they also present risks related to overspending and debt management.

Cash, in contrast, encourages a disciplined approach to budgeting and spending while lacking some of the consumer protections associated with credit. The choice between cash and credit should ultimately depend on your personal circumstances, financial goals, and spending habits.